Need SR-22 insurance assistance?

CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance |

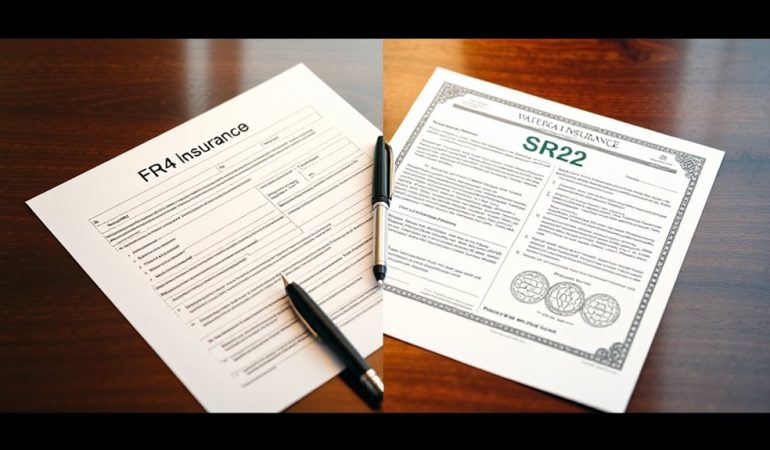

Examining the Benefits of FR44 Insurance for High-Risk Drivers.

Driving is a responsibility and privilege that should be taken seriously. Handling a motor vehicle with care and caution is an important part of ethically operating a car or motorcycle. Unfortunately, some drivers make serious errors or take risks that can often lead to increased insurance rates. FR44 insurance is an invaluable asset to high-risk drivers, boasting a range of advantages that can be greatly beneficial.

Firstly, FR44 can offer satisfactory rates, often lower than those associated with regular insurance, making it a cost-effective choice for conscientious drivers on a budget. These policies also provide viable protection from increase in premium rates if a mistake or accident is made in the future. Equally important is the fact that most FR44 policies cover medical expenses; this is especially beneficial to drivers who may be at an increased risk of injury due to their past mistakes or risky behaviour.

Furthermore, FR44 policies are immune to cancelation and can provide coverage across multiple states. This allows the driver to switch states without re-applying for insurance or suffering a change in coverage; always a great asset for someone who leads a nomadic or transient lifestyle. In addition to this, there a range of perks depending on the company, such as cashless repair, free towing, discounts in selected garages and even a temporary replacement car when necessary.

Another factor to consider is that FR44 can help drivers with a lot of expensive tickets or DUI/ DWI issues in the past be accepted by insurers; something that was previously impossible without paying extremely high rates. This program provides individuals with an opportunity to go back on the roads safely and without needing to breach the bank. Moreover, they can get the same levels of coverage as a risk-free driver and receive the services of an insurer who cares about their safety first and foremost.

Finally, FR44 provides a win-win situation for all parties involved. It allows the high-risk driver to enjoy the same services and protection that regular car owners receive. Additionally, the insurer is protected from huge losses due to the substantial coverage that FR44 requires of high-risk drivers. They are also able to provide the driver with security and pursue the idea of financially responsible driving habits.

When it comes to further examining the benefits of FR44 insurance for high-risk drivers, one must explore the financial implications for individuals who opt for this insurance policy. This type of coverage can be incredibly affordable for those who have had trouble insuring vehicles in the past due to their driving record; not to mention, they can also enjoy other perks such as discounts and access to cashless repair services. More to the point, it’s a great option for obtaining the insurance coverage required in many states.

FR44 insurance can also enhance the driver’s reputation among transportation authorities. This helps those who have been banned from driving or who had to restart their license due to trouble on the roads. With its help, they can eventually convince the authorities that they are taking their duty of driving responsibly and taking auto insurance coverage with them, if need be; ultimately demonstrating their dependability and character.

Moreover, FR44 can give these drivers the peace of mind that their insurance will remain in effect regardless of future mishaps or mistakes. This way, high-risk drivers can safeguard their cars without worrying too much about their financial responsibility should they become liable for a loss. Equally important is the fact that they will get priority access to medical attention and other support systems while on the roads.

In conclusion, FR44 insurance holds a range of positive benefits for high-risk drivers. This type of protection can often provide better rates and coverage than those provided by regular policies; giving drivers the safety and peace of mind they need when it comes to operating a vehicle. On top of this, it allows high-risk drivers to pursue greater financial responsibility while giving them access to a variety of perks and discounts. Ultimately, insurance may be important regardless of your driving record, but FR44 can be of great help to those who have had issues in the past.